Can I Sell My House For More Than The Appraised Value?

An appraisal is the best way to estimate your property’s fair market value based on the location, condition and recent sales of similar homes in the surrounding area. Beyond an estimate of how much your property is worth, an appraisal also indicates the amount a lender will let the buyer borrow for your property.

If you have a cash buyer, they don't need an appraisal to be made for a lender's approval.

What Does An Appraiser Do?

Before we get into what happens when the appraisal comes back lower than the offer price, let's first look at what an appraiser does.

The home appraisal process involves a licensed individual called an appraiser. The appraiser can tell you, the buyer, and your lender how much a home is worth.

An appraiser analyzes a handful of factors when they’re tasked with the appraisal of your home. They will consider where your home is located, check the quality and condition of the home’s construction, its amenities and any other special features. The appraiser also looks at the size of the property and any major structural improvements such as additions and remodeled rooms.

Specifically, an appraiser will analyze:

The exterior of a home:

- The total land area or acreage of the property

- The condition of the property

- Any lead or peeling paint, but only if the house was built prior to 1979

The interior of a home:

- The HVAC system

- Rooms, windows and closets

- The garage, though it does not contribute to the square footage of the home

- Whether the basement is upgraded, though it also does not contribute to the square footage of the home

- Any built-in appliance upgrades

- The presence of an in-ground pool

The appraiser will rate the condition of the property “good, average, fair or poor” after they’ve evaluated it. Then, they’ll compare it to other homes in the area using special appraisal support software. Comparable properties are other homes that have sold within the past 6 months nearby that are similar in size and sale price.

Appraisal Amount Vs. Mortgage Loan Amount

An appraisal directly affects the amount of mortgage loan the buyer can get because their lender gives a home loan based on the appraisal’s estimate of the fair market value of the home. It keeps the lender from lending too much money and keeps them from borrowing more than you need for a particular home.

If A House Is Appraised Lower Than The Purchase Price

What happens if the appraisal comes in below the purchase price of the home? Though it might be an unexpected scenario, it can happen (especially with what is going on right now in the Dallas/Fort Worth real estate market), and it’s best to be prepared.

A low appraisal doesn’t mean that a lender won’t lend money. It means that the lender will give a loan based on the loan-to-value (LTV) ratio agreed to in the proposed contract. The LTV compares the size of the loan with the value of the home. The buyer might need to bring more money to the table to make up the difference.

If A House Is Appraised Higher Than The Purchase Price

What happens if the appraisal comes in above the purchase price of the home? You’re in a good situation if this happens. It simply means that the buyer can obtain a loan for the full amount.

Appraised Value Of A House Vs. Sales Price

The sales price is the amount that a seller asks for a property and is completely different from the appraisal value.

As you can imagine, it’s in the seller’s best interest to try to get the home appraised for a value that matches the selling price. If an appraisal comes back low, a buyer can go back to the seller and negotiate a lower sale price. If the seller refuses, the buyer could end up walking away from the home completely.

Though an appraiser isn’t looking for things like paint on the walls or children’s toys in the yard, small things can still affect the appraiser’s overall assessment. It’s important to note that while appraisers evaluate some of the obvious issues that may affect the value of a home, appraisals are different from a home inspection.

A home inspection is a much more detailed walkthrough of a home and examines wear and tear, risks, damage and hazards. A borrower will still need to do an inspection even if you have an appraisal done on a home.

Here are a few things you can do to influence the appraisal:

- Clean your home. The cleaner it is, the more the great elements of the home will pop out to an appraiser.

- Double-check items that leave a first impression of your home. This could include the paint on the walls, handrails, railings on decks, plumbing, roof leaks and cracks in the walls, ceiling or foundation. Check on water intrusion anywhere in the home, particularly in the foundation.

- Make known repairs before an appraiser arrives. If you know the roof has some leaking issues or the basement is in need of repair, make those repairs ahead of time.

- Organize receipts and take photos of any renovations or improvements. New appliances and other new features, such as repairs to the leaky roof, should be kept as proof of the home’s improvements.

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

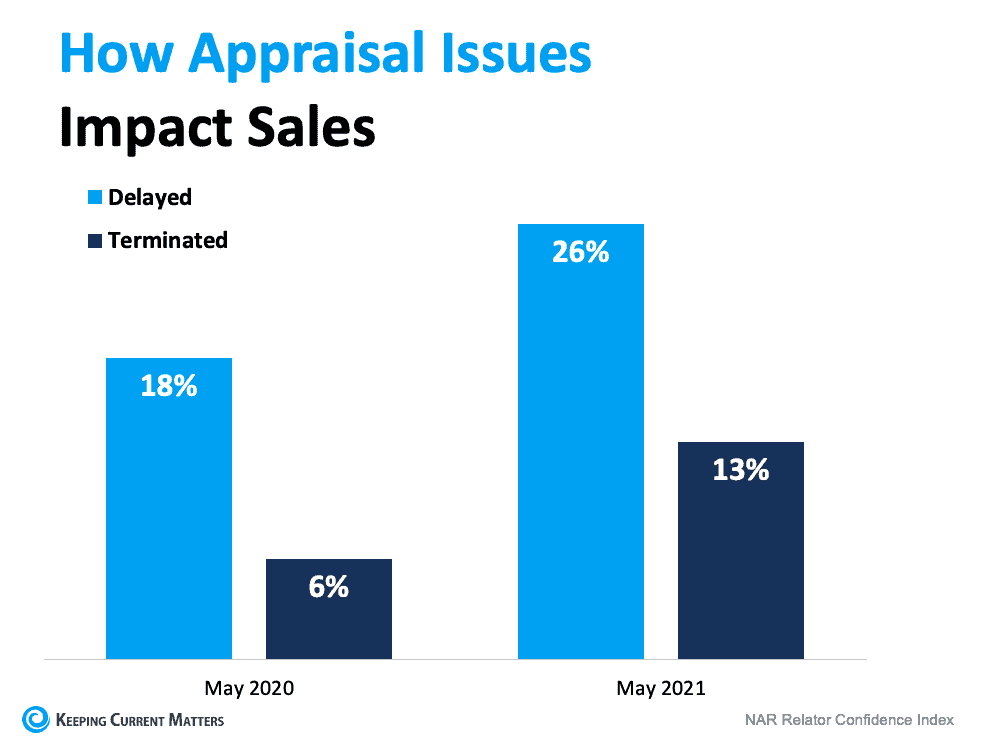

The chart above uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year.

If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market.

Bottom Line

Whether you’re buying or selling, we are your ally. They’re with you throughout the process and are there to help you navigate the unexpected, including potential appraisal gaps.

CLIENT SUCCESS STORY

Meet John & Lynn

"We were busting at the seams! The house we were living in was our starter house. It was great when it was just Lynn and I, but when our two kids came along we quickly realized we needed more space!"

John & Lynn had some hurdles to jump - figure out how to sell their house & buy a new construction home at the same time. They also did all of this during the COVID-19 pandemic!

Our Selling Programs:

Instant Cash Offer

Want to bypass the traditional selling process? The Tosello Team will connect you a competitive, no obligation cash offer from an iBuyer for your home, so you can skip out on showings and move on your own time.

Fix Up, Sell Up

Get your home prepped for sale without the hassle or any out-of-pocket costs with a service provider.With most iBuyers and Cash Offer programs, you’re on your own to negotiate, and it can be difficult to determine the actual net proceeds you’ll earn from selling your house.

Our Selling Programs:

Buy Before You Sell

Make a winning, all-cash offer.

In the conventional home buying process, you need to sell your current home so you can purchase your next one. This leads to rushed decisions and unnecessary stress. Not anymore.

We have access to a program to get you the cash you need to buy before you sell so you stay in control.

Sell Your House With Us

We will market your house like crazy to generate the highest price in the shortest amount of time.